How to trade the stock market? A beginner’s guide to trading via proven strategy.

- gavinchiuyy

- Mar 22, 2022

- 3 min read

Updated: May 10, 2022

Very often, I read news seeing that retail investors are losing their money in the stock market due to reasons like herd mentality and greed, as well as not investing in themselves sufficiently prior to investing and/or trading in the stock market. I particularly agree to a saying by Benjamin Graham, the father of value investing that: The stock market is a place that transfer wealth from the ignorant investor to the knowledgeable investor.

So, let us dive into the topic on how to trade. First, we need to recognize that there are different price movements within the stock market, where the stock price can go up, down or remain unchanged. These changes are man-made, where 80% of the time, it is manipulated by the market makers. Imagine market makers as a big shark, swallowing all the smaller fishes where the latter being us as retail investors and traders.

Next, there are many different types of trading methodology, but one that I personally practice is swing trading where I undertake technical analysis on fundamentally good stocks. Doing so, I essentially combined both the practice of Dr Van K. Tharp, the famous turtle trader in the world as well as Warren Buffett’s (one of the greatest fundamental investor in the world) long-time practice of fundamental investing.

On trading, I personally focus a lot on the technical charts, where I view the charts with Japanese candlesticks like the one below:

Then on, I determine the different support and resistance levels on a full charting platform. I personally recommend using Trading View's charting software, as they are quite user-friendly and easy to navigate around. In lay man’s term, a support point is price level that drives buying interests, while a resistance point is price level that activates selling interests.

For more details on how to identify support and resistance levels, one can view the video below:

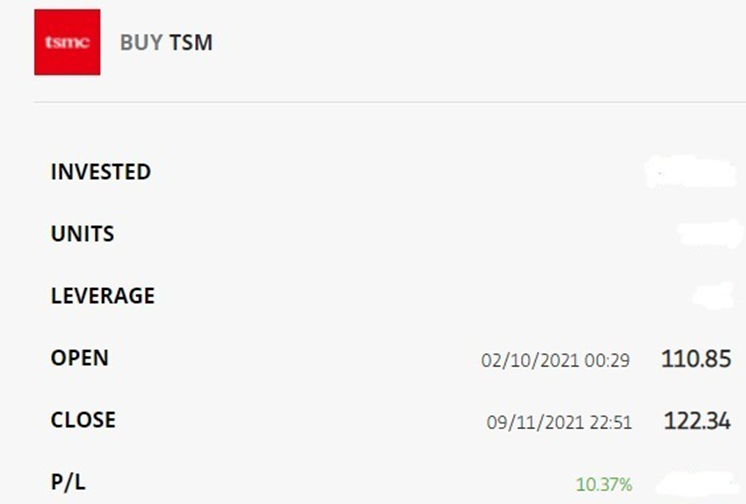

Let us look at one case study below, where I have generated consistent profits from it, based on technical and fundamental analysis:

The stock in focus is Taiwan Semiconductor Manufacturing (TSM), which is the primary semiconductor supplier to Apple’s chip processor, and its clientele includes AMD, Sony and many more. Fundamentally, it is extremely strong and technically, the chart pattern has demonstrated great resilience over the past year. As seen above, I have identified support levels at $112 and $109, whereas resistance levels sit at around $123. Combining this buy and sell signals, the Return of Investment stands around 10%.

Concurrently, the support level is breached due to negative market sentiment arising from the geopolitical crisis but attached below is one of my past results from trading this stock.

The stock market is described by many as a double-edged sword. However, if we are equipped with the relevant knowledge and skillsets, it actually helps us expedite the time taken to reach financial freedom. I will end off with a quote from Warren Buffett: Be greedy when others are fearful and be fearful when others are greedy.

References:

Adam Khoo. 2017. “Identifying Support & Resistance Levels in Stock Trading Charts by Adam Khoo.” YouTube video, 30:55. https://www.youtube.com/watch? v=SgXOw_wOaBw

Foot, Patrick. n.d. “What is a Japanese candlestick?” IG Group Holdings Plc. Accessed: April 18, 2022. https://www.ig.com/en/trading-strategies/japanese-candlestick-trading- guide-200615

Gupta, Yashi. 2022. “TSMC’s Top 10 high-profile clients as of 2022.” TechnoSports. Accessed: April 18, 2022. https://technosports.co.in/2022/01/22/tsmcs-top-10-clients- 2022/

Krulwich, Robert. 2014. “The Power Of Poop: A Whale Story.” NPR. Accessed: April 18, 2022.

https://www.npr.org/sections/krulwich/2014/04/03/298778615/the-power-of-poop-a- whale-story

Lobosco, Katie. 2018. “Can I start investing with $500?” Warner Media Company.

https://money.cnn.com/2018/05/17/pf/how-to-start-investing/index.html

Mitchell, Cory. 2022. “What is Swing Trading.” Investopedia. Accessed: April 18, 2022.

https://www.investopedia.com/terms/s/swingtrading.asp#:~:text=Swing%20trading %20is%20a%20style,to%20look%20for%20trading%20opportunities.

.jpg)

Comments